All Categories

Featured

Table of Contents

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your busy life, monetary self-reliance can appear like a difficult goal.

Fewer companies are supplying conventional pension strategies and several companies have actually reduced or terminated their retirement strategies and your capacity to count entirely on social protection is in concern. Even if advantages have not been minimized by the time you retire, social safety and security alone was never ever intended to be enough to pay for the way of living you desire and are worthy of.

Now, that may not be you. And it's crucial to know that indexed universal life has a great deal to offer individuals in their 40s, 50s and older ages, along with individuals who wish to retire early. We can craft a service that fits your specific circumstance. [video: An illustration of a man appears and his wife and child join them.

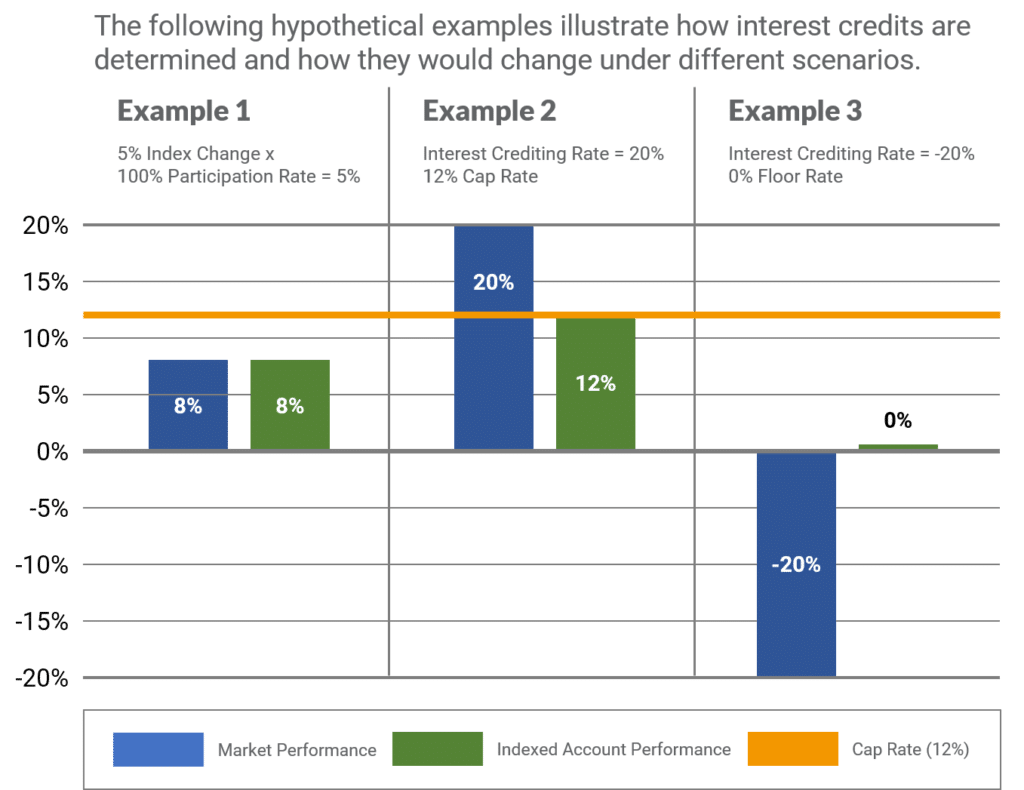

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, intend this 35-year-old guy needs life insurance to secure his family and a method to supplement his retired life revenue. By age 90, he'll have received practically$900,000 in tax-free earnings. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And ought to he pass away around this moment, he'll leave his survivors with even more than$400,000 in tax-free life insurance policy benefits.< map wp-tag-video: Text boxes show up that read"$400,000 or more of defense"and "tax-free earnings via plan car loans and withdrawals"./ wp-end-tag > As a matter of fact, throughout all of the accumulation and dispensation years, he'll get:$400,000 or even more of protection for his heirsAnd the opportunity to take tax-free earnings via plan finances and withdrawals You're possibly asking yourself: Exactly how is this possible? And the answer is basic. Rate of interest is tied to the efficiency of an index in the stock exchange, like the S&P 500. The cash is not directly invested in the supply market. Interest is credited on a yearly point-to-point segments. It can provide you a lot more control, flexibility, and options for your financial future. Like many individuals today, you may have accessibility to a 401(k) or other retirement. Which's a fantastic primary step in the direction of conserving for your future. Nevertheless, it is necessary to recognize there are limits with qualified strategies, like 401(k)s.

Universal Life Insurance Providers

And there are constraints on when you can access your cash scot-free. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take money out of a qualified plan, the money can be taxed to you as income. There's an excellent factor many individuals are transforming to this unique solution to solve their financial goals. And you owe it to yourself to see how this can function for your own individual circumstance. As component of an audio financial method, an indexed global life insurance policy plan can aid

Pacific Life Indexed Universal Life Insurance

you handle whatever the future brings. And it provides unique capacity for you to develop substantial money worth you can make use of as added revenue when you retire. Your cash can expand tax delayed through the years. And when the policy is created properly, circulations and the death advantage won't be exhausted. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is essential to talk to an expert agent/producer that recognizes just how to structure an option such as this correctly. Before committing to indexed global life insurance policy, below are some advantages and disadvantages to take into consideration. If you select a great indexed universal life insurance policy plan, you may see your cash worth grow in worth. This is helpful due to the fact that you might have the ability to gain access to this money prior to the strategy ends.

Term Life Insurance Vs Universal Life Insurance

Given that indexed universal life insurance requires a specific level of threat, insurance policy firms tend to maintain 6. This kind of plan also uses.

Finally, if the chosen index does not execute well, your cash money worth's development will certainly be influenced. Usually, the insurance provider has a vested passion in carrying out far better than the index11. However, there is typically a guaranteed minimum rates of interest, so your plan's growth will not drop below a certain percentage12. These are all aspects to be thought about when picking the very best sort of life insurance policy for you.

Universal Life No Lapse Guarantee

Nonetheless, considering that this kind of policy is a lot more complex and has a financial investment component, it can commonly feature higher premiums than various other plans like whole life or term life insurance policy. If you do not think indexed universal life insurance is appropriate for you, right here are some options to consider: Term life insurance policy is a temporary plan that normally uses coverage for 10 to 30 years.

Indexed global life insurance policy is a sort of policy that supplies more control and adaptability, along with higher cash value development capacity. While we do not provide indexed universal life insurance policy, we can provide you with even more info about entire and term life insurance policy policies. We recommend checking out all your alternatives and talking with an Aflac agent to uncover the best fit for you and your family.

The rest is included in the cash worth of the policy after fees are deducted. The cash money value is credited on a monthly or annual basis with interest based upon rises in an equity index. While IUL insurance policy may verify important to some, it's important to recognize how it functions before acquiring a plan.

Table of Contents

Latest Posts

Universal Life Insurance Good Or Bad

Iul Unleashed

Linked Life Insurance

More

Latest Posts

Universal Life Insurance Good Or Bad

Iul Unleashed

Linked Life Insurance